This material is intended as information only and does not contain, and should not be construed as containing, investment advice or an investment recommendation or an offer of solicitation for any transactions in financial instruments. Past performance is not a guarantee of, or prediction of future performance.

Articles in this section

What is CFD?

CFD means ‘Contract For Difference’. It is an agreement between two parties to exchange the difference in the value of a currency, commodity, index or share between the time you enter and exit the agreement.

You do not actually hold the underlying asset, you only consider the price change of the asset.

As an example, let’s say you ‘Buy’ a CFD at $10 and ‘Sell’ it at $12. You will receive the $2 difference. On the other hand if you ‘Sell’ a CFD at $10 and ‘Buy’ it at $12, you will lose $2.

What are the benefits of CFD?

- Huge range of instruments

- Allows smaller investors to participate in the markets.

- You can buy(long) and sell(short) an asset and even buy and sell the asset at the same time (hedging)

- Faster execution with immediate settlement.

What is Long and what is Short?

Long or ‘Buy’ is a type of trade that a user buys an asset with the hope that the asset price will rise in value and thus make a profit.

On the other hand, Short or ‘Sell’ is a type of trade when a user sells an asset with the hope that asset price will drop and make a profit.

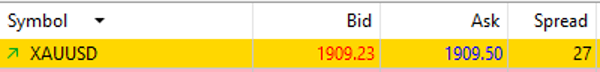

What is Bid and Ask and Spread?

As shown above there are two figures for every instrument.

- Bid is the price that a trader can Sell (go short) on an instrument

- Ask is the price that a trader can Buy (go long) on an instrument

- Spread is the difference between the Ask and Bid price and is referred as the ‘Cost of trading’.

The Bid and Ask prices shown are the ToB (Top of the Book) prices, in other words the figures shown are the best available prices at that moment.

Using the figure above, if a trader Buys 1oz of XAUUSD (Gold) and closes the trade immediately, without the price moving, then the trader will lose $0.27. The same applies for the Selling side.

In general, all Sell positions open at the Bid Price and close at the Ask Price, similarly, all Buy positions open at the Ask Price and close at the Bid Price.

It is important to note that the charts are constructed using the Bid Price.

What is slippage?

Slippage is a normal market condition that happens for a number of reasons. Slippage is the difference in price between the requested and executed price of a trade. Why this happens?

Slippage can occur when an instrument is illiquid (low liquidity). This means that there it might take more time for your trade to execute and the price might change. When we say more time we mean fraction of seconds or milliseconds which is enough for the price to change! Slippage can be either in favor or against the client. Low liquidity usually appears on exotic fx pairs or on days where some major exchanges are closed and there is not enough transactions on the day.

Another reason for slippage is high volatility which usually happens during major economic news, during market opening and during market closing. Usually during these periods, the prices of the instruments can move rapidly up and down and traders can receive slippage during this period

Lastly, a big volume of buying or selling of an instrument can cause slippage. Let’s explain this more. As explained earlier, the BID and ASK prices shown on your platform, refer to the best available Bid and Ask prices on an instrument at that particular moment (Top of the Book prices). These prices are only available for a certain volume.

As an example below, we can see that, if a trader decides to Buy XAUUSD, the current price is $1909.50. This price is available for only a certain amount of Gold Oz. If a trader decides to buy a huge amount of Gold at that time, the client would buy an X amount of Oz at 1909.5 and the rest of the volume would be bought at a worst price (above $1909.50). The average opening price of your position will be shown, which is named VWAP (Volume Weighted Average Price).

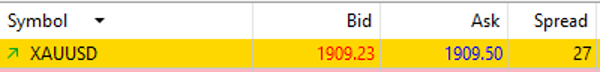

Types of orders

- Market Order: This is an order to buy or sell at the current market price that is available. The system automatically aggregates the volume received from third party liquidity providers and executes the ‘market order’ at VWAP (‘Volume-Weighted Average Price’) which is the average and best available price at the time of execution.

- Pending Orders:

- Stop Orders: This is an order to ‘Buy’ or ‘Sell’ once the market reaches the stop price. One the market reaches the set stop price, the ‘Stop Order’ is triggered and treated as market orders which can be executed at the requested, better or worse price depending on the liquidity at the time.

Stop orders include: Sell Stop, Buy Stop and Stop Loss. Note that Stop Out is also a stop order.

- Stop Orders: This is an order to ‘Buy’ or ‘Sell’ once the market reaches the stop price. One the market reaches the set stop price, the ‘Stop Order’ is triggered and treated as market orders which can be executed at the requested, better or worse price depending on the liquidity at the time.

- Limit Orders: This is an order to ‘Buy’ or ‘Sell’ once the market reaches the limit price. Once the market reaches the limit price, the ‘Limit Order’ is triggered and executed at the requested or better price.

Limit orders include: Buy Limit, Sell Limit and Take Profit

- Limit Orders: This is an order to ‘Buy’ or ‘Sell’ once the market reaches the limit price. Once the market reaches the limit price, the ‘Limit Order’ is triggered and executed at the requested or better price.

The diagram below visualizes how the orders can be placed:

What is a lot?

In trading, a “lot” = refers to a standardized unit of measurement for a financial instrument, such as a stock or currency. The specific definition of a “lot” can vary depending on the asset being traded, but it generally represents a specific number of units or a specific amount of money. For example, in the foreign exchange market, a standard “lot” is typically equal to 100,000 units of the base currency of the pair. For example, 1 lot EURUSD is €100,000, for USDCHF 1 lot is $100,000 and so on.

Hint: All FX are quoted in pairs – the rate between the two currencies. For example EUR/USD or GBP/CHF. The first currency is called the Base currency and the second currency is called the Quote currency.

XB Markets also offers mini lots and micro lots:

- Standard Lot (1.00) = 100,000 of base currency

- Mini Lot (0.10) = 10,000 of base currency

- Micro Lot (0.01) = 1,000 of base currency

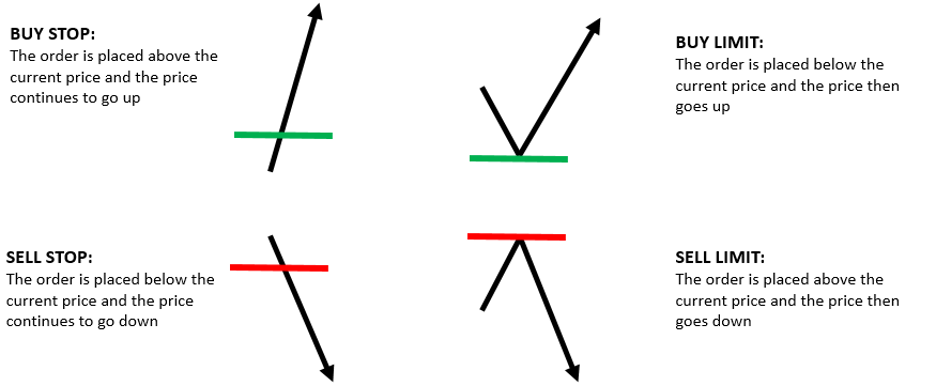

For other instruments, each lot represents a standard amount, for example UKOIL.c 1 lot is 1,000 barrels, for XAUUSD (GOLD), 1 lot is 100oz. You can find the lot size (contract size) of every instrument https://www.xbmarkets.com/instruments/ or by visiting our MT5 platform:

Right Click on a symbol and click ‘Specifications’

What is a pip?

A ‘pip’ (point in percentage) is the smallest standard increment in which a currency pair can move. For almost all pairs, a pip is the fourth digit after the decimal point. A popular exception is the Japanese yen, where a pip is a change in the second digit after the decimal point.

This is an example of how pair quotes are displayed, and the pip for each pair is highlighted:

EUR/USD = 1.13422

GBP/CAD = 1.71791

USD/JPY = 110.771

Calculating PIP Value

The monetary value of each pip (and therefore ‘point’) is determined by the currency pair and the trade size you place.

This is extremely important as your profit or loss is calculated by multiplying the number of pips that the price went in “your direction” or “against you” by the specific pip value.

To calculate Pip Value for FX, you can use the formula:

Pip in decimal places X Trade size in units = Pip value in ‘term’ currency

Pip in decimal places X Trade size in units / exchange rate = Pip value in ‘base’ currency

For Example:

Pip in decimal places specifies which digit is the pip, so for most pairs, this is 0.0001 (a pip is the 4th digit after the decimal). In this case, 1 lot is always equal to 10 of the term currency (0.0001 X 100,000 = 10

For pairs where the pip is quoted to the 2nd decimal (for example JPY pairs), 1 lot will be equal to ¥1,000 since 0.01 X 100,000 = 1000

Please see the table below which visualizes how the pip value is determined:

| MT5 Volume* | Trade Size (units) | EUR/USD (0.0001 = pip) | USD/JPY (0.01 = pip) |

| 0.01 (micro lot) | 1,000 | $0.10 | ¥10 |

| 0.10 (mini lot) | 10,000 | $1 | ¥100 |

| 1.00 (standard lot) | 100,000 | $10 | ¥1000 |

Please refer to the topic above regarding the lot definition.

What is leverage?

Leverage in CFD (Contract for Difference) trading refers to the ability to control a large position in an underlying asset (such as a stock, commodity, currency, or index) with a relatively small amount of capital. CFDs are leveraged products, which means that traders can gain exposure to a large position with a smaller initial investment, by borrowing money from the broker.

For example, if a trader wants to buy a $100,000 position in a stock, but only has $10,000 in their trading account, they can use leverage to gain exposure to the full $100,000 position. The trader would only have to put up $10,000 as collateral and the broker would lend the remaining $90,000. This allows the trader to control a larger position than they could with their own capital alone, but it also increases the risk of losing more than the initial deposit.

However, if you don’t use leverage wisely, it is possible to lose the entire Equity in a very short space of time– and you may not even notice it!

Therefore, leverage is a double-edged sword, and you need to consider how much risk you are willing to take.

Traders can choose their leverage level when opening a CFD position, with XB Markets offering leverage of up to 1:30. You can find more information on leverage at https://www.xbmarkets.com/instruments/ .

It is important to note that with higher leverage comes higher risk, and traders should be aware of the potential for significant losses and should manage their risk accordingly.

How leverage works?

Leverage is often being described as being “borrowed” funds from the broker, however this is not accurate, because the broker does not add funds into your account, instead, the funds required to place each trade is reduced by the level of leverage you set.

For example, if you trade 1 lot of EURUSD (€100,000) with 1:1 leverage (no leverage), you will need to have 100,000 EUR in your account to enter this trade.

If you trade 1 lot of EURUSD (€100,000) with 1:10 leverage (leverage is 10) then you will need €10,000 in your account to place this trade.

Let’s look at some examples:

- With an initial investment of €10,000 and leverage 1:10, this means that for every €1 you have, you have a buying power of €10 , so you can open a position of €100,000. Let’s say you ‘Buy’ 1 lot EUR/USD and the price chart moves up by 100 pips, this means that your profit will be $1,000*.

- With an initial investment of €10,000 and leverage 1:10, this means that for every €1 you have, you have a buying power of €10 , so you can open a position of €100,000. Let’s say you ‘Buy’ 1 lot EUR/USD, however, instead of increasing, the chart drops 100 pips. It this case, your deposit of €1,000 may be lost.

During volatile markets and when using excessive leverage, it is possible for your deposit to disappear almost instantly. This is why it is so important to understand leverage and risk, and its relationship with margin and free margin.

* Profit is calculated in the Quote currency.

What is margin?

Margin is the amount of funds ‘locked’ (required) to open a trade and kept until the trade is closed. The margin required depends on the instrument, the size and the leverage used.

In general, Margin = 1 / Leverage.

For example, if you leverage is 1:10 then the margin is 10%, if the leverage is 1:20 then the margin is 5%.

Let’s say you want to open 1 lot EURUSD (€100,000) with a leverage of 1:20. The margin required is 5%, as 1/20 = 5%, therefore you only need €5,000 margin to open this trade.

To calculate it you can use the formula:

Trade size in units / Leverage = Margin in base currency

Trade size in units / Leverage X Exchange rate = Margin in quote currency

Note that the ‘Margin’ figure displayed in your account details represents the total used margin for all open trades.

As mentioned earlier, Margin Required depends on the leverage. The higher the leverage the fewer the funds needed to open a trade and vice versa.

Let’s see another example on FX,

If you are using 1:30 leverage, and trade 1 lot of EURUSD at 1.12151, then the margin requirement would be

100,000 / 30 = €3,333.33

If the account currency is in USD, then using the formula above, the margin requirement would be

Trade size in units / Leverage X Exchange rate = Margin in quote currency

100,000 / 30 x 1.12151 = $3,738.37

Remember that with higher leverage comes higher risk, and traders should be aware of the potential for significant losses and should manage their risk accordingly

Margin requirement for the rest of the Assets.

The general formula for calculating the margin requirement for the rest of the instruments:

Trade size in units / Leverage X Market Price = Margin in base currency of the asset

Let’s say you open a trade of 1 lot Gold at $1750.13 . We know that the contract size for Gold is 100oz and the leverage for Gold is 1:20, therefore:

100oz / 20 x 1750.13 = $8,750.65*

*assuming the account currency is USD. If the account is in another currency, the system will convert the $8,750.65 to the required currency using the exchange rate at that time.

Account Figures

What do all these figures mean?

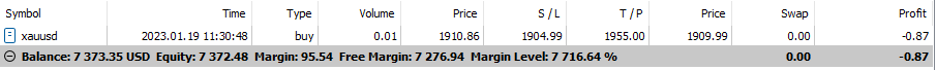

Let’s look at the example above and explain what each figure means.

- Symbol – XAUUSD (GOLD) is the symbol that the above user is trading. XB Markets has more than 1,000 instruments across 5 different asset classes

- Time – The time that the trade was opened

- Type – The type of transaction, it can either be ‘Buy’ hoping that the price will go up and thus making a profit or ‘Sell’ hoping that the price will drop and make a profit.

- Volume – The number of lots the user is trading, in this case the user traded 0.01 lots of Gold. We know that the lot size for gold is 100oz, so the user is trading 1oz.

- Price – This is the price that the client bought XAUUSD

- S/L – The client can set a Stop Loss in order to minimize their loss. The user has placed a Stop Loss at 1904.99. This means that once the Bid Price reaches 1904.99, the system will close your position at the next available price.

- T/P – Take Profit works with the same logic as Stop Loss but on the upside of a trade, meaning that a TP can be used to close your positions once the user in profit. The user has placed a Take Profit at 1909.99, therefore once the Bid Price reaches our TP price the system will close the position at the next available price.

- Price – As you have noticed there is another column with the name ‘Price’. This shows the current price of the instrument. In this example, the current Bid Price of XAUUSD is 1909.99.

- Swap – Swap is the overnight funding that is debited or credited on your account. It is paid/charged on all your positions kept open at 00:00 server time.

- Profit – Profit is any unrealized PnL shown in the account currency. In this case the user is losing $0.87

- Balance – Balance is the money you have before entering a trade. In this example the user has a balance of $7,373.35

- Equity – This is simply the Balance + any unrealized PnL. The user is losing $0.87 and the balance is $7,373.35. Then the Equity is 7373.35 – 0.87 = $7,372.48

- Margin – The margin locked for all open positions. Let’s do the Maths below:

Trade size in units / Leverage X Market Price = Margin in base currency of the asset

- x 100oz x 1910.86 / 20 = $95.54

This means that the user needs a margin of $95.24 to enter this trade.

- Free Margin – This shows the available margin you have to enter more positions. The equation is Equity – Margin (7,372.48 – 95.54 = 7,276.94)

- Margin Level – Margin Level gives you an indication of how many times the current capital you have (including open trades) is covered by the money you paid to open your trades (required margin). The formula is Equity x 100 / Margin = Margin Level %

= 7372.48 x 100 / 95.54 = 7,716.64%

Note that you need at least 100% margin level to be able to open a trade and most importantly, once the Margin Level drops to 50%, the system will automatically Stop Out (more below) your position(s) until the margin level is above 50%.

Remember that, long or ‘Buy’ positions open at the Ask Price and close at the Bid Price, similarly all short or ‘Sell’ positions open at the Bid Price and close at the Ask Price

What is a Stop Out?

Stop out is a measure to prevent clients from falling to Negative Balance, however this is possible during volatile markets or during market openings when an instrument opens with a gap against the client’s favor. At XB Markets, the Stop Out Level is set at 50%. Let’s say you are in a trade that uses a Margin of $500, the system will start to close your positions once your Equity drops to $250.

It is extremely important to understand and monitor your margin level to avoid closing your positions.

Legal: XBMarkets.com is a website operated by Redpine Capital Ltd, which is authorised and regulated by the Cyprus Securities and Exchange Commission, licence number 391/20.

Registered Address: Vasili Michaelidi 21-23, Areti Tower, 2nd Floor, 3026 Limassol, Cyprus

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.57% of retail investor accounts lose money when trading CFDs . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please consider our Risk Disclosure.

Restricted regions: Redpine Capital Ltd provides services primarily to residents of countries from the European Economic Area (EEA). The information on this site is not intended for residents of Belgium or the United States, or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation, or where AML restrictions exist, as per the policies of the Company.

Copyright © 2024. All rights reserved.